What Determines My Credit Score?

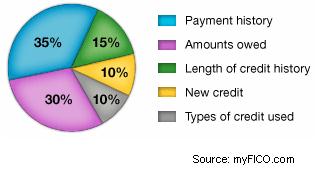

The key credit score model is produced by the Fair Isaac Corporation (FICO). They state that 90% of businesses and lenders use their model to decide whether or not to lend you money and determine the interest you’ll pay on the line of credit you receive. The five main principal determinants of your credit score, and the percentages assigned to them, are:

- Payment History – 35%

- Amounts Owed – 30%

- Length of Credit History – 15%

- Types of Credit Used – 10%

- New Credit – 10%

The FICO score takes into account both positive and negative information on your credit report. Late payments are considered negative and will drop your FICO Score; creating a consistent history of timely payments can improve your score.

Factor #1: Payment History

Your payment history is the most important aspect of the FICO score – making up 35% of your score. Your payment history measures your ability to pay your bills on time. If you have late payments or skipped payments on loans or credit card bills, it will show up on your score as a negative – even one slip up will impact your score. Each time you are late or miss a payment the negatives build to further damage your credit score. Another important factor to consider is the most recent late payments damage your credit more than those that occurred several years ago.

Factor #2: Amounts Owed (Debt Load / Debt Utilization)

How much reported debt you are carrying makes up 30% of your score. FICO determines your debt load by analyzing how much of your available credit you are using, which is also called credit utilization OR debt utilization. Your credit utilization ratio is measured by your amount owed compared to your total available credit. This is a significant factor because if you happen to cancel a credit card that you don’t use and that has a zero balance on it, (which may seem like a smart idea) the action can reduce your credit score – because it reduces your available credit. Ideally, you want to maintain your credit card balances at roughly 10%-20% of your available credit lines.

Factor #3: Length of Credit History (Age of Your Accounts)

The age of your reported accounts makes up 15% of your credit score. Older accounts with a solid record of on-time payments are an indication that you are a reliable bill payer, and this tends to increase your score. New accounts don’t help very much, especially if you open a new account and suffer a late payment. That’s an automatic drop to your credit score.

Factor #4: Types of Credit Use (Diversity of Credit)

Types of credit or diversity, makes up 10% of your credit score. This means the types of accounts showing up on your report, which may include auto loans, school loans, mortgage, and credit card bills. This diversity combined with an on-time payment history, can increase your score.

Factor #5: New Credit (Applications and Credit Inquiries)

The amount of new credit you are applying for makes up 10% of your credit score. Applying for credit is fine, but if you are applying for significant amounts of new credit, such as new credit cards, a red flag usually pops up. That type of action is generally viewed as a sign that you are desperate for cash and can negatively impact your credit score.